From a strong German property and casualty insurer to the international Group

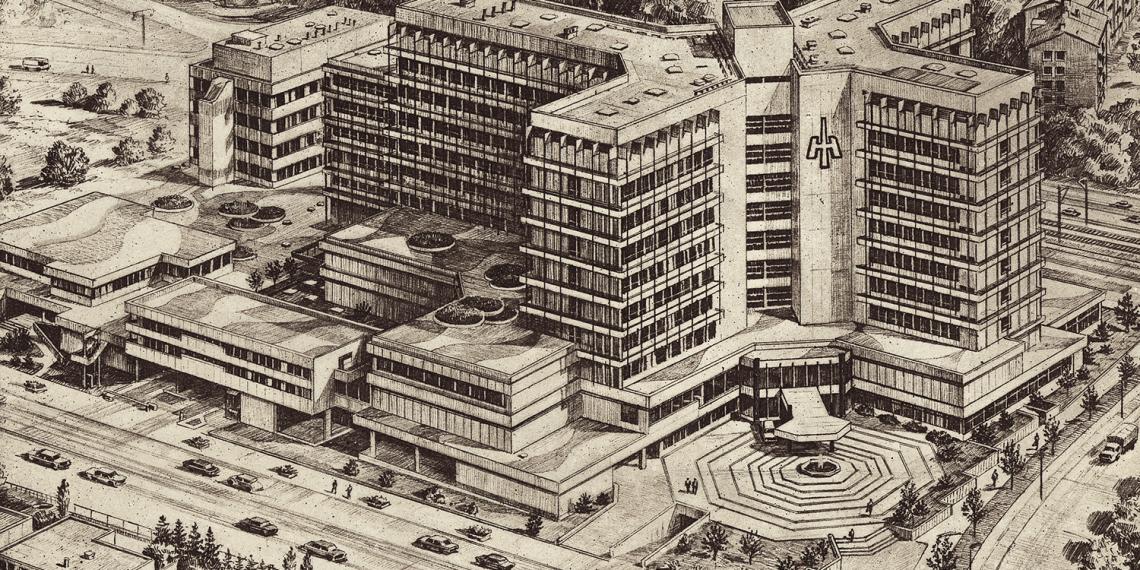

1970

In 1969, the Haftpflichtverband had a premium income of DM 159 million, that of the Feuerschadenverband rheinisch-westfälischer Zechen was around DM 47 million. The two associations complemented each other perfectly, not only in their lines of business. Both were organised as mutuals, the Feuerschadenverband had no branch network of its own, which made a merger all the easier. After the merger the new company went by the name of "Haftpflichtverband der deutschen Industrie und Feuerschadenverband V.a.G.," in 1976 the name was changed to "Haftpflichtverband der Deutschen Industrie V.a.G." with the by now familiar abbreviation HDI.

1978 – 1983

Towards the end of the 1970s, a HDI corporate group gradually took shape; its premium income topped one billion DM for the first time in 1977. At that time the consolidated financial statements included only five companies. New companies and additional participations arose as the Group accompanied industrial members into international business – both in Europe and overseas. By 1989, 22 companies in Germany and abroad were consolidated in the Group's financial statements.

1987

One reason for the Group's growth was extended services provided for members especially in the field of safety engineering. HST bundles HDI's decades of experience in risk reduction and loss prevention.

1991

Deregulation of insurance supervision in the late 1980s opened up the European single market for primary insurance business, too. At the same time, significantly stiffer competition made it necessary to pursue a unique position on the global market and to re-define the Group's strategic objectives. HDI's strengths – industrial insurance, motor insurance and reinsurance – were in highly risk-exposed business areas: it was necessary to invest in areas that offered prospects of a steadier profit and that protected the Group against fluctuations. A first step was to set up a life insurance company. The life insurance side was significantly expanded in the following years.