Give me five!

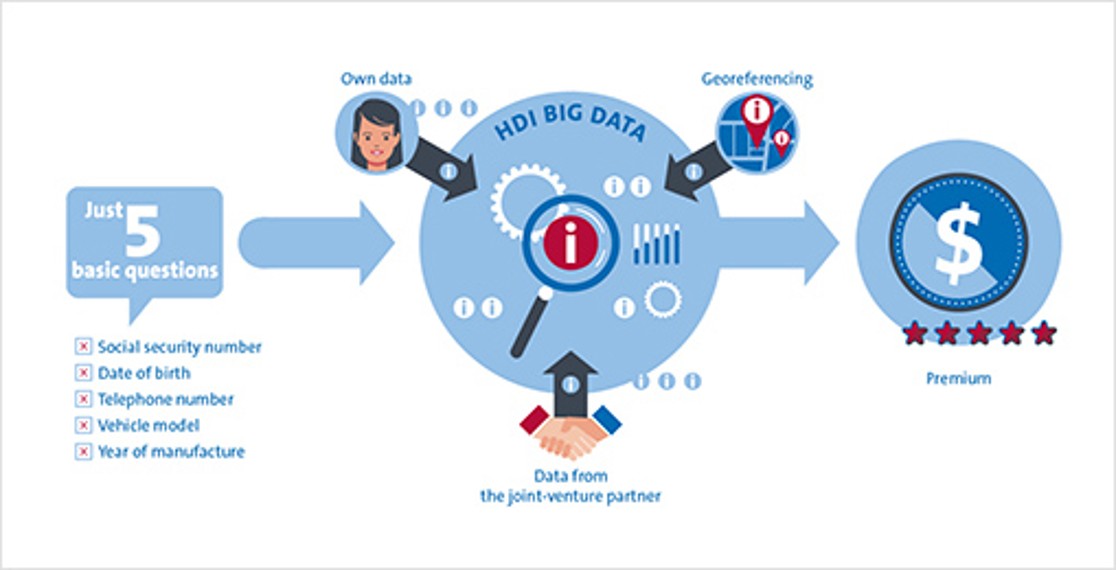

Date of Birth, phone number, vehicle model, year of manufacture, social security number. Brazilian insurer HDI Seguros S.A. doesn’t require any further information in order to calculate a motor insurance tariff tailored specifically to each customer. In a nutshell: for any customer who has previously purchased an automobile and financed the purchase through Santander.

HDI has joined forces with the Spanish bank and has just launched a new digital insurer. The joint venture docks onto the ecosystem of Brazil’s third-largest bank, which additionally happens to be the number one there for financing the purchase of automobiles. The Santander network in Brazil has approximately 10,000 automobile dealers. Anybody purchasing a car there receives a finance offer – and will in future be given the opportunity to click directly on a motor insurance policy at the dealer’s.

Seamless docking onto the bank

This cooperation enables HDI to pursue the goal of improving its position in the motor market. “We have specialised in motor insurance policies and in this area we are already one of the biggest insurers in the market,” commented Murilo Riedel, Chairman of the Management Board of HDI Seguros. “Our challenge for the coming years is to achieve maximum success in this business. The partnership with Santander is an important step in this direction.”

It is a step that involves an important prerequisite. The bank uses just five questions to establish through the car dealer under which conditions it is prepared to offer the dealer’s customers finance for the purchase. And as far as HDI was concerned, precisely these five questions were the benchmark and the objective for docking seamlessly onto the processes of the bank. The challenge was for no more information to be necessary in order to calculate the premium for motor insurance. By way of comparison, an insurer usually requires dozens of items of information from their customers.

Police in the vicinity?

Big Data and Artificial Intelligence make this possible. “We have the opportunity to test innovative variables that we never imagined could be helpful in calculating a premium,” said CEO Murilo Riedel. “Artificial Intelligence revealed connections between the data that a human being would never have perceived.” HDI has a great deal of information available that allows the insurer to augment the five items of information that the customer supplies at the car dealer. These include own data, information from the cooperation with Santander or georeferencing. For example, if the potential customer lives near a police station, the risk of their car being stolen is significantly less.

AI delivers precise results

The real challenge for HDI was to filter out the most relevant information from this large volume of data and to identify patterns that are necessary for obtaining a precise calculation of the premium. And this process was successful. The algorithms deliver results that are virtually identical with the methods used in conventional calculation of premiums.

Murilo Riedel has a correspondingly optimistic outlook on the future. “We can see numerous opportunities for making use of Artificial Intelligence in our processes, for example in automation, in the calculation of other products or in combatting fraud.” HDI has now decided to extend its new method of calculation to brokers, the most important sales channel in Brazil. “The idea is to create an offer that allows the customer or our broker to receive the ideal product for the risk and the appropriate price with just one click,” said Murilo Riedel. The plan for achieving this involves HDI in asking just three questions.